Welcome to Homeseed’s Mortgage Market Update, where we dive into the latest trends, insights, and changes shaping the dynamic landscape of the housing and lending industries.

Mortgage Rate Trends & Forecasts

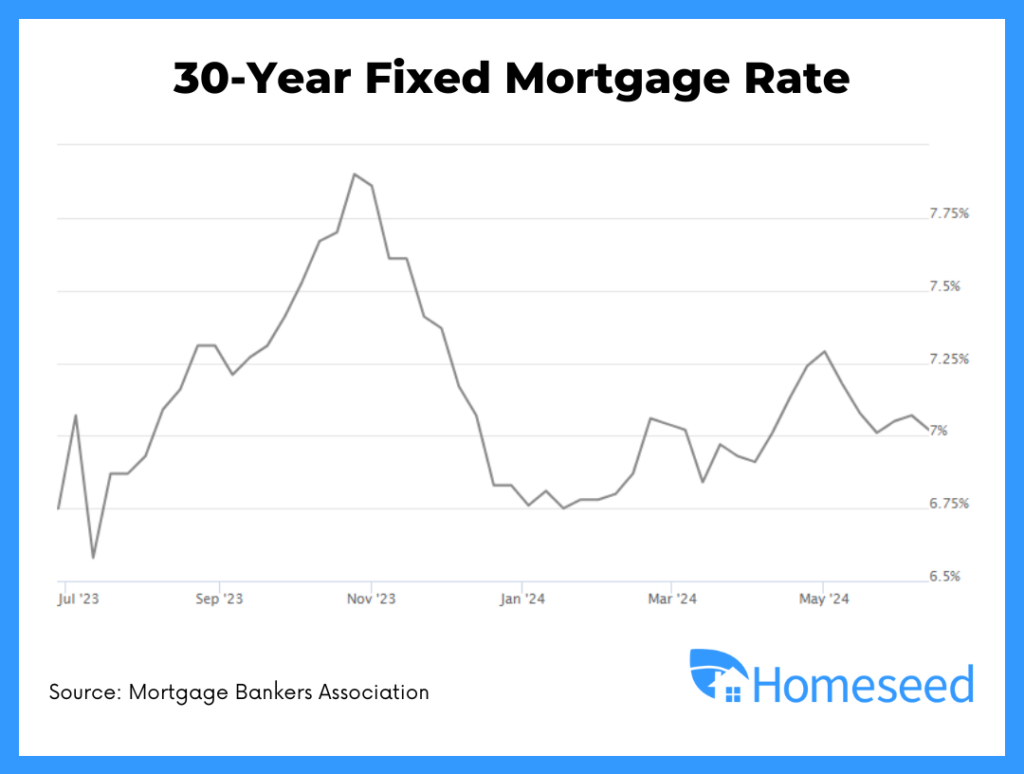

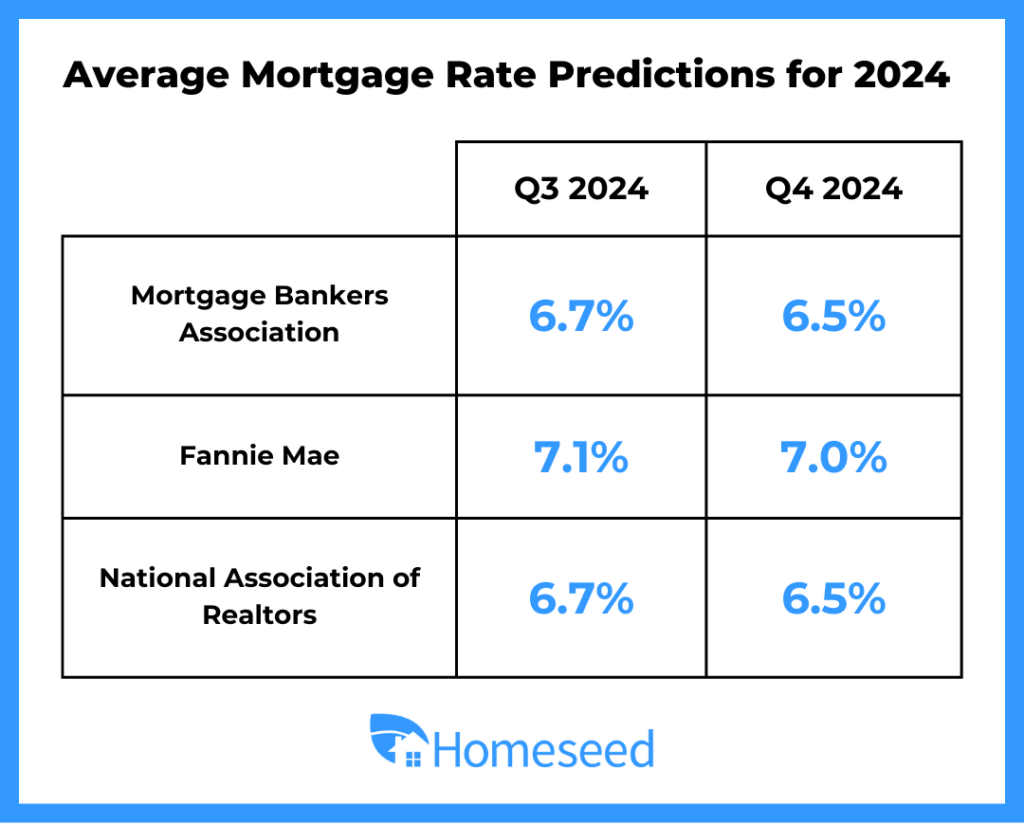

- Mortgage rates are slightly lower on a week-over-week basis and have been fluctuating within a narrow range over the last month.

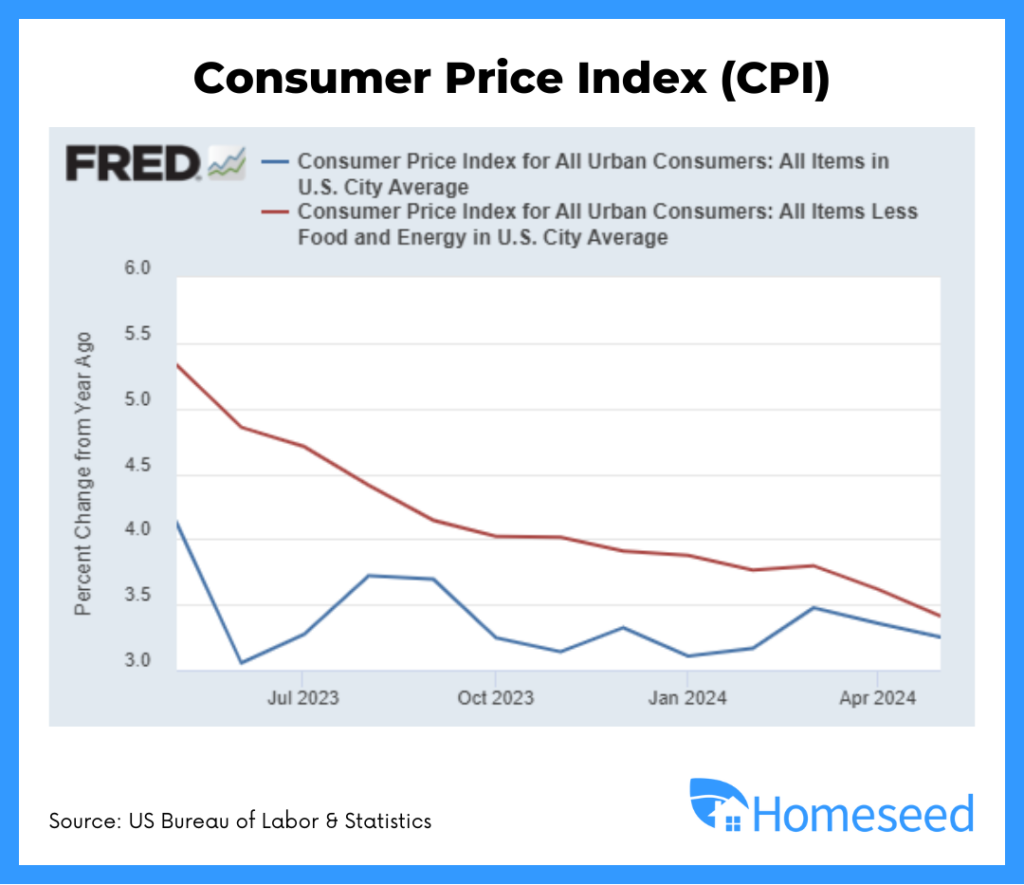

- Expectations are for tomorrow’s CPI report to show year-over-year inflation decreasing from 3.3% to 3.1%, which would be good for mortgage rates.

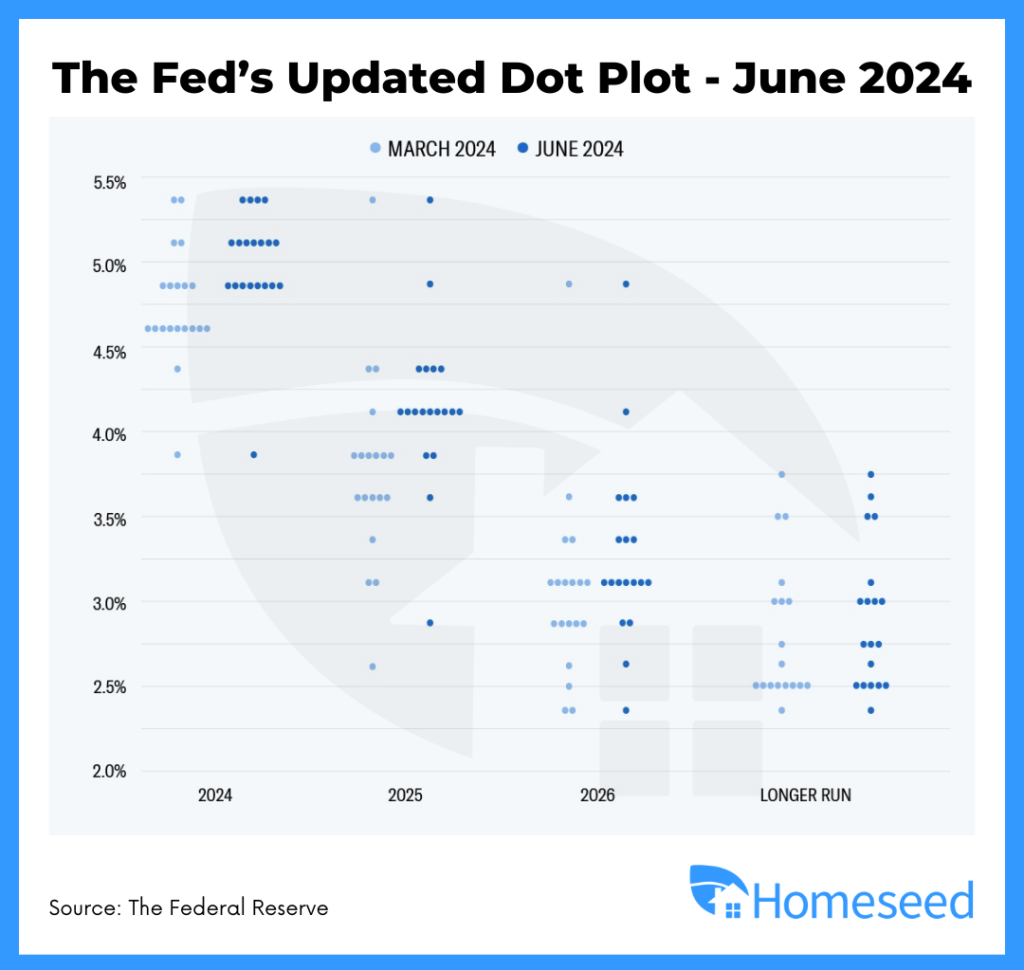

- Market futures are showing two potential rate cuts by the end of 2024 as having the highest probability.

Consumer Price Index

- Headline inflation fell from 3.3% to 3.0% year-over-year,

- June CPI showed a large moderation in the shelter component.

- There is a long lag in reflecting real world market conditions, but we continue this trend in shelter inflation lowering.

BLS Jobs Report

- June’s job growth was slightly above estimates with a reported 206,000 new jobs created.

- However, there were big revisions to the two previous months with a combined 111K jobs removed.

- Unemployment also rose to 4.1%, which triggered a reliable economic indicator suggesting we are already in a recession.

Digging Deeper on Housing Inventory and Prices

- Active inventory has risen 6.7% in June and is up 37% year-over-year, but this is from very low numbers with one third of the increase coming from two states alone – Florida and Texas.

- On the moderation of median home prices, this is skewed by the mix of sales (lower priced homes are selling more than higher priced homes), which brings down the median price sold.

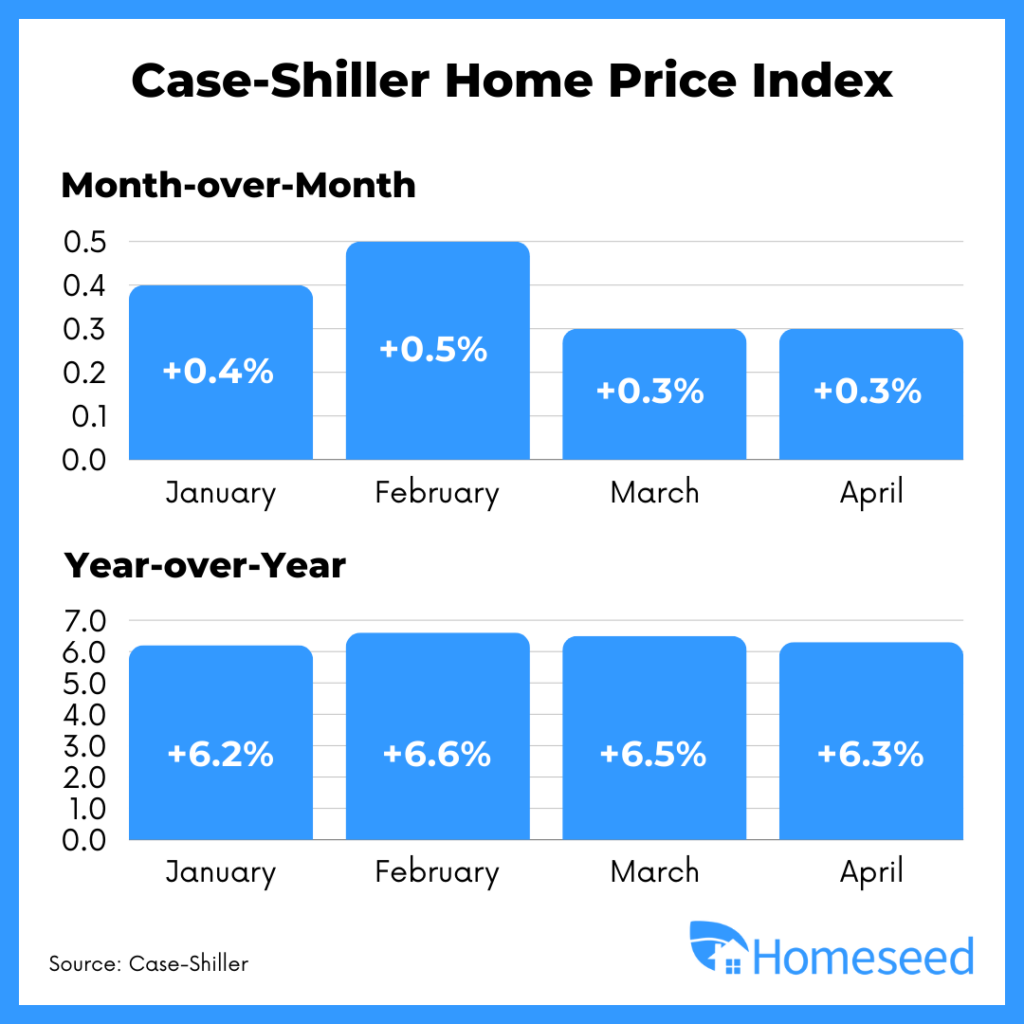

- Home values across the board are increasing as shown in the recent Case-Shiller Home Price Index and inventory remains much lower than pre-pandemic levels.

- RATES EDGE SLIGHTLY UNDER 7% – Mortgage rates average just under 7% for top tier scenarios according to this index.

https://www.mortgagenewsdaily.com/… - WHEN WILL RATE CUTS COME – The Fed says it needs greater confidence inflation is moving towards its 2% goal before they will cut rates.

https://www.cnbc.com/… - AFFORDABILITY CHALLENGES – How getting inflation back towards the Fed’s 2% target will help housing.

https://www.housingwire.com/… - LUMBER PRICES FALLING – Lumber prices at record lows could spur new housing starts.

https://www.morningstar.com/…